Week 7 (November 4, 2018)

Summary

Here is what we covered:

1) Reviewed information on EPS and PE Ratios and Dividends and the kids are now more comfortable with it.

2) We covered Insurance. How it works. How to find good insurance etc.

Homework:

Both Level 1 and Level 2: Sell ONE stock from your portfolio and buy an INSURANCE COMPANY. When you buy it, don't forget to also write down the EPS, PE Ratio, Beta and Market Cap.

See you on Sunday!

Registration for next semester will open on Friday.

Week 6 (October 27, 2018)

Summary

Here's what we covered:

Stocks:

We finished all the basic indicators of stocks and focused today on Dividends, Earnings Per Share and P/E Ratio.

Homework:

1) FIXED INCOME: In your portfolio, under Fixed Income (Money you make by loaning money) GREEN section. Do the following:

- Add the name of the GIC you decided to invest in.

- Add the interest rate for the GIC.

- Calculate the DAILY interest rate for the GIC. (1st Hint: you divide the annual interest rate by the number of days in a year. 2nd Hint: there are 365 days in the year).

- EVERY DAY calculate the interest and the total for FIXED INCOME.

- If you can't figure out how to do it, email me.

2) STOCKS

1) Make sure the Market Cap, Beta, EPS and PE Ratio are added for each stock. (Add columns in your spreadsheet to the left of Number of Shares if it's not there)

2) Stock Trading

Level 1: Sell BOTH your stocks. (Yes, you will survive!). Buy 1 stock with a PE that is OVERVALUED and another with a PE that is UNDERVALUED. Follow these stocks the rest of the week. Every time you buy and sell charge $7 for broker commission and pay it from your cash amount.

Level 2: Sell any TWO stocks ( You will still have 3 left in your portfolio) Buy 1 stock with a PE OVER 100 and another with a PE UNDER 15. Follow these stocks the rest of the week. Every time you buy and sell charge $7 for broker commission and pay it from your cash amount. This means, every time you sell a share you put under Cash, "Brokerage Fees/ Commission" and minus $7.

3) Level 2 Daily Quiz. This is for level 2 only.

Since we have covered a lot we will be doing a daily quiz to make sure you know how to apply it. Parents are requested NOT to help as the goal is really to see how much they understood. I will send kids in Level 2 the question by email. The first person who sends me the 100% correct response by email will get a boost of $100 for the next day. Trust me, you need the boost. Level 1 is at 10,000++++.

See you next week!

Week 5 (October 21, 2018)

Summary

We did a quick review of everything we have learnt and then started to learn about Mutual Funds. They learnt about NAV, how to buy a mutual fund and we started looking at the fees associated with them.

In Stocks, we learnt about Market Cap and Beta.

This week, we are trying to get kids to try investing in stocks they would not normally invest in and getting them to look outside their comfort zone.

Homework

1) Complete the homework on GIC from last week! We need it done before we can get into Fixed Income on the Investment Challenge. Here is the link to it: Click here for the exercise.

2) Update your Investment Portfolios like this:

Level 1

1) Sell 1 stock you have.

2) Buy stock in a company which has a Beta OVER 1.82

Know what the company does! I will be asking you.

Level 2

Of the 5 stocks you have, sell the 2 BEST PERFORMING stocks. (it's ok you will survive!)

Buy the following:

1) 1 stock which has a Beta > 1.82 .

2) Another stock of a company which has a Market Cap less than 5B.

Make sure you know exactly what the company does.

For instructions on how to show which stocks you sold and which ones you bought in the spreadsheet do this:

Week 4 (October 14, 2018)

Summary

We started off by talking about how the stock markets had performed over the last couple of weeks and discussed what the impact of the Fed Interest Rate going up had on the market. Our Investment Challenge is in full swing and this was a great week for kids to start it, because every one lost a part of their principal - it really showed them how much risk they can tolerate and how risky the markets are.

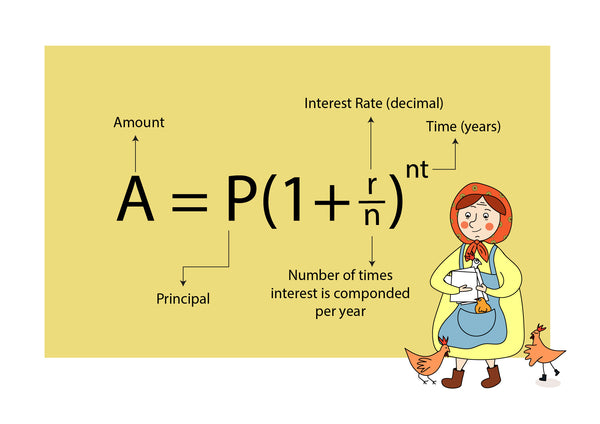

We learnt a lot about FIXED INCOME today. They learnt why it is called Fixed Income, How to earn money on Fixed Income products, the difference between Simple and Compound Interest, what are the risks of fixed income products and what are the different types of fixed income products.

Homework

1) Everyone needs to complete this exercise where they research the different rates available for 6 month and 12 month GIC to figure out who gives them the best rate. Click here for the exercise.

2) Every day update your portfolio with the price of the stock and the amount of interest you earned that day. Instead of using Day 1, Value 1 etc to record your stock information, please now add columns in the blue section and call them Price (Oct 15) Value (Oct 15) etc. Any questions? Send me a message on your google docs sheet.

3) Every day calculate the value of interest you would have earned. The formula looks complicated but it's really not. We went through it and you need it for life :-) Any questions? Send me a message on your google docs sheet.

See you next week!

Week 3 (September 30, 2018)

Summary

We spoke a lot about the stock market and how to select a stock and follow it.

All kids are encouraged to read the news everyday and suggest that they download the following free apps on their phones: CNN, BBC news and YAHOO Finance

We went through a few of the stock indicators on Yahoo Finance today:

Stock Price, Stock Market, Change in Price, Currency traded in,

Previous Close: Price on closing on previous day

Open: Price at open today

Bid: The highest price investor is willing to pay for the share

Ask: The lowest price the shareholder is willing to sell the stocks

Day's Range: The price changes through the day

52 Week Range: The price range through the previous 52 weeks

Volume: Number of shares traded that day

Avg Volume: Number of shares traded on average

Next class, we will learn about the rest of the indicators and they will use them a lot in the next few weeks.

Homework

1) All kids need to complete their stock portfolios daily. This means fill in the current price of the stocks they are following and the value of their stocks (Price * number of shares). In their portfolios it is the BLUE rows. The $10,000 principal has been divided up based on their homework from last week.

To access the folder with all the portfolios - please click here.

All individual portfolios are here and your child can complete theirs. They would also have received a link to the portfolio by email.

2) The INVESTMENT CHALLENGE is ON!! This means several times during the week we will declare the winner who has the largest gain to their portfolio.

3) Download the following apps and read what is going on in the news and with their stocks EVERY DAY (Yes, this means less time on Fortnite! YAY!). The news apps are: CNN, BBC or anything else that they prefer. Financial Apps: Yahoo Finance.

NOTE

There is NO CLASS next week Oct 7. Happy Thanksgiving to everyone!

Next class is on October 14.

Week 2 (September 23, 2018)

Summary

We covered the following topics today:

1) Review the homework the kids did on the different interest rates offered at banks and calculated what interest they would have earned at the end of 1 year. They were surprised to find out that the amount of interest they would get after one year varied between $1 and $150. You can check out their homework submissions here and here.

2) We also went through the different parts of a Debit cart and what the features are. They learnt about the magnetic strips and the information stored there and also about the microchip in the front.

3) We went through how to use their debit card at ATM and one of the kids even used their card to demonstrate. All the kids know what to do when they are in front of an ATM now.

4) We learnt how the Government insures the money in the bank and walked through the official govt brochure on it.

5) Finally, we talked about how most investments belong to one of these categories:

a) Investments you buy (Stocks, Cars, House etc)

b) Investments you loan money to (Interest Rate Products, Bonds etc)

c) Cash

We had a lively discussion about this.

6) Investment Challenge starts next week!! YAY!!

Each child will get a virtual portfolio of $10000 which they will use to invest in a wide range of things.

Each week we will have a winner that will be announced on the blog.

Homework: (DUE FRIDAY Sept 28th)

1) From Last Week: If your child has not submitted their homework from last week here are the links again:

a) https://explorerhop.com/blogs/gallery/which-bank-for-me

b) https://explorerhop.com/pages/mission-which-bank-is-for-me

2) This week's homework

a) Use their debit card to Withdraw and Deposit money. They need to withdraw from the teller and then deposit using the ATM. They know what to do so parents are advised to just sit and let them go ahead and talk and figure it out. It's important they do it themselves as it helps them understand how the bank works.

b) If they have not opened their bank accounts at Meridian (Yonge & St Clair) - go ahead and do it as the offer for $50 expires on Saturday. If you are going there on Saturday, email Kerelle (Branch Manager) and set up an appointment. Her email is: Kerelle.Lovelace@meridiancu.ca . For branch hours and location scroll below.

c) Complete this Homework which helps them decide how to allocate funds in their account. https://explorerhop.com/pages/mission-create-a-financial-portfolio

d) Investment Challenge. Kids get to decide which level they are playing. For those at Level 1 (lower level), think of 2 stocks you want to invest in. For those at Level 2 (higher level) think of 5 stocks you want to invest in.

Discussions at home: Children and parents are encouraged to talk to parents about Risk Tolerance in terms of Money and what the philosophy is of the family and why they came upon this thinking. There is no right / wrong answer in this, it's simply to make kids aware of the choices parents make and what drives these choices.

NOTE:

Next week is photo day so that our blog is not so sad. We will add smiley pics of the children with the Branch Manager. If you do not want your child's photo added, please let me know.

No class the week after on October 7 (Thanksgiving Weekend)

See you next week!

____________________

Week 1 (September 16, 2018)

We have an amazing bunch of kids this term - all so interested and focused!

Today we looked at how to save, for kids who were in Summer Camp this past summer the discussions were much different and they learnt a fair amount through that. They also learnt how to prevent wasting and how buying food and throwing it away was the same as putting money in the garbage.

We then learnt about the banking system and how there are 4 different types of banks in Canada and what is good/ bad in all of them.

Homework

All kids have 4 pieces of homework to do (all due Friday, September 21)

1) All kids need to open a bank account with Meridian Credit Union. We have organized for them to get $25 free when they open the account and in the next class they will learn how to operate the account. They will also get a Debit Card and we will also teach them how to use that safely. This is important because we will be using this account to teach them how to withdraw and deposit safely.

If your child has siblings, you can also get $25 off an account for them.

To open the account, please go to the following bank:

MERIDIAN CREDIT UNION

26 St Clair Ave E ( Yonge & St Clair)

Hours: Monday to Wednesday: 9.30-5.00pm

Thursday and Friday: 9.30 - 6.00pm

Saturday: 9.30am - 3pm

Speak to: Kerelle (Branch Manager) or Jade. Please tell them your children are enrolled in Explorer Hop program.

You can only get $25 free if you go to this branch.

You will need to take the following documentation with you to open the account:

- Govt issued ID for you and your child (drivers liscence, passport, birth certificate)

- SIN Card / SIN Number

- Proof of Address if not on driver licence

2) Kids need to complete this online form to identify their saving goals.

3) Kids need to do an analysis of the different types of banks and complete the form here.

4) Only for kids who have previously been to Explorerhop Summer Camp: Kids should bring 2-3 stocks they are interested in following. For kids who have not been exposed to stocks, do not worry, we will be covering this next week.

Discussions at home:

Spend some time discussing with the family to see how they can help the family save money every month from their budget. The goal really is to get parents and kids talking about money matters that impact them.

See you next week!

_________

Getting Ready for Our Class

Dear Parents

Thank you for entrusting us with teaching your child about money. We are excited to meet them and work with them over the next few weeks.

Here is some information to make your first day easier.

- Classes are held at Median Credit Union, 26 St Clair Avenue East. (corner of St Clair & Alvin) . Please climb the stairs and enter the branch, we will be waiting for your child there.

- Parking is available behind the building in the Green P parking lot.

- Classes start at 10.30am and Pickup is at 12 noon. Doors will open at 10.20am. All children should be picked up promptly at 12.

- NO PHONES OR DEVICES allowed in class. We find this distracts from the learning.

- Children should bring a non-messy snack and a water bottle.

- Kids will get a little homework to do every week (find stocks, compare interest rates etc). This should be done and submitted by Thursday. All responses will be shown on our web site.

- Should you have any questions, please feel free to email me at hello@Explorerhop.com or phone/text me at 416-833-1782. If this is during class, I will return your call after class has ended.

- Waivers needed! We will need some waivers signed on Sunday to allow us to post images of your child on our blog etc. Please sign those when you drop off your child. Click here for the document.

- Please bookmark this page as you will get updates every week on what we studied, portfolio winners and what homework they need to do.

See you on Sunday!