Week 7 (November 4, 2018)

Summary

We spent time really understanding the ideas of EPS (Earnings per share), Dividends and PE Ratio (Price to Earnings Ratio).

We continued our discussion on Mutual Funds and learnt about all the charges involved and how to select one.

We also had a lively discussion about events around the world and how they are impacting the stock market. The main discussion point was around the upcoming mid-term elections in USA. The class analyzed and predicted what would happen if either party won.

Homework:

Continue to follow your stocks and add the price. It is important to do so this week because the market has been uneasy and we could see some movement now.

Put your games away, and watch the news on Tuesday and Wednesday to make sense of this crazy world we live in.

Week 6 (October 28, 2018)

Summary

We learnt about Earnings Per Share and PE Ratio. They learnt how to calculate both.

We also learnt about Mutual Funds and the costs involved in them.

Homework:

FIXED INCOME (Green Section)

Add the GIC you are buying and the interest percentage. Calculate the amount using Compound Interest on a daily basis.

Here is more detail:

- Under the Fixed Income Section (Green area on the portfolio) do the following:

- Add the GIC that you decided to invest in. You can find your answers here:

- Add the interest rate of that GIC.

- Calculate COMPOUND interest EVERYDAY.

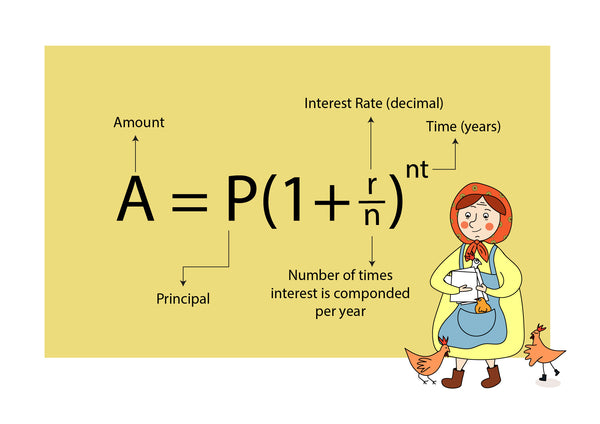

- Here is how you calculate compound interest.

Let's assume you are investing $1000 and the interest rate is 3.45%

Step 1: Take the interest rate and divide it by 365. So in our example you do 3.45 ÷ 365 = 0.009%

Step 2: On the first day (Monday, Oct 29) calculate the interest earned on that day. This is Principal x Interest . So, in our example it is $1,000 + 0.009%= $1,000.09

Step 3: On second day (Tuesday, Oct 30) calculate the interest earned on that day. You start with the amount on Monday and then add the interest to it. So, in our example it will be $1,000.09 + 0.009%=$1,000.18

Step 4: On the third day you take the amount from from the second day and again add the daily interest to it. Continue like this till Friday.

Stocks (BLUE Section)

Complete the sections where you add the Market Cap, Beta, EPS and PE Ratio for all the stocks

Level 1 (Ashley): Continue following the stocks you are doing. Sell 1 stock and buy a stock which has a PE > 100.

Level 2: Sell 2 Stocks. Buy 1 stock with a PE>100 and another stock with a PE<15. Follow them by adding price and value every day.

Daily Quiz to get Boost $ (Level 2 only)

Every day this week, I will send kids in Level 2 the question by email. The first person who sends me the 100% correct response by email will get a boost of $100 for the next day. Parents are requested NOT to help as the goal is really to see how much they understood. Trust me, you need the boost. Level 1 is at 10,000++++.

Week 5 (October 21, 2018

Summary

We learnt about investing in Gold today. The class learnt about the different types of precious metals and when is a good time to invest in gold.

In Stocks, we learnt about Market Cap and Beta.

In our Investment Challenge we are making teens look at stocks they would not normally have looked at.

Homework

1) Complete the GIC Comparison homework from last week as we can't continue with fixed income till it's done. https://explorerhop.com/pages/mission-find-your-fixed-income-product

2) Do the following exercise to figure out if Gold is a good investment long term. https://explorerhop.com/pages/mission-gold-vs-the-stock-market

2) Investment Challenge:

Level 2 (Ryan, Alex): Of the 5 stocks you have, sell the 2 BEST PERFORMING stocks.

Buy the following:

1) 1 stock which has a Beta > 1.82 .

2) Gold Stock. If you already have Gold Stock then buy a stock which has a Market Cap less than 5B.

Level 1 (Ashley)

Continue following your stocks. I have added columns for you to fill out the Market Cap and the Beta for the 2 stocks you have. Price and Value should be done every day.

Abtin: You need to input the information into the sheet. Email me if you have questions.

Week 4 (October 14, 2018)

Summary

We started off by talking about how the stock markets had performed over the last couple of weeks and discussed what the impact of the Fed Interest Rate going up had on the market. Our Investment Challenge is in full swing and this was a great week for kids to start it, because every one lost a part of their principal - it really showed them how much risk they can tolerate and how risky the markets are.

We also learnt about Market Cap and how Apple was the first Trillion dollar company and compared the risks involved in investing in Apple versus smaller companies.

We learnt a lot about FIXED INCOME today. They learnt why it is called Fixed Income, How to earn money on Fixed Income products, the difference between Simple and Compound Interest, what are the risks of fixed income products and what are the different types of fixed income products.

Homework

1) Everyone needs to complete this exercise where they research the different rates available for 6 month and 12 month GIC to figure out who gives them the best rate. Click here for the exercise.

2) Every day update your portfolio with the price of the stock and the amount of interest you earned that day. Instead of using Day 1, Value 1 etc to record your stock information, please now add columns in the blue section and call them Price (Oct 15) Value (Oct 15) etc. Any questions? Send me a message on your google docs sheet.

3) Every day calculate the value of interest you would have earned. The formula looks complicated but it's really not. We went through it and you need it for life :-) Any questions? Send me a message on your google docs sheet.

See you next week!

Week 3 (September 30, 2018)

Summary

We spoke a lot about the stock market and how to select a stock and follow it.

All kids are encouraged to read the news everyday and suggest that they download the following free apps on their phones: CNN, BBC news and YAHOO Finance

We went through a few of the stock indicators on Yahoo Finance today:

Stock Price, Stock Market, Change in Price, Currency traded in,

Previous Close: Price on closing on previous day

Open: Price at open today

Bid: The highest price investor is willing to pay for the share

Ask: The lowest price the shareholder is willing to sell the stocks

Day's Range: The price changes through the day

52 Week Range: The price range through the previous 52 weeks

Volume: Number of shares traded that day

Avg Volume: Number of shares traded on average

Next class, we will learn about the rest of the indicators and they will use them a lot in the next few weeks.

Homework

1) All kids need to complete their stock portfolios daily. This means fill in the current price of the stocks they are following and the value of their stocks (Price * number of shares). In their portfolios it is the BLUE rows. The $10,000 principal has been divided up based on their homework from last week.

To access the folder with all the portfolios - please click here.

All individual portfolios are here and your child can complete theirs. They would also have received a link to the portfolio by email.

2) The INVESTMENT CHALLENGE is ON!! This means several times during the week we will declare the winner who has the largest gain to their portfolio.

3) Download the following apps and read what is going on in the news and with their stocks EVERY DAY (Yes, this means less time on Fortnite! YAY!). The news apps are: CNN, BBC or anything else that they prefer. Financial Apps: Yahoo Finance.

NOTE

There is NO CLASS next week Oct 7. Happy Thanksgiving to everyone!

Next class is on October 14.

Week 2 (September 23, 2018)

Summary

We covered the following topics today:

1) Reviewed the homework the kids did on the different interest rates offered and calculated what that would amount to at the end of 1 year. They were surprised to find out that the amount of interest they would get after one year varied between $5 and $150. You can check out their homework submissions here and here.

2) We also went through the different parts of a Debit cart and what the features are. They learnt about the magnetic strips and the information stored there and also about the microchip in the front.

3) We went through how to use their debit card at the teller and the ATM machine and all kids will practice this as homework this week.

4) We learnt how the Government insures the money in the bank and walked through the official govt brochure on it.

5) Finally, we talked about how most investments belong to one of these categories:

a) Investments you own (Stocks, Cars, House etc)

b) Investments you loan money to (Interest Rate Products, Bonds etc)

c) Cash

We had a lively discussion about this.

6) Investment Challenge starts next week!! YAY!!

The class has been divided into 2 groups for the Investment Challenge

Each child will get a virtual portfolio of $10000 which they will use to invest in a wide range of things.

Level 1: Ashley

Level 2: Everyone Else

Each week we will have a winner that will be announced on the blog.

Homework: (DUE FRIDAY Sept 28th)

1) From Last Week: If your child has not submitted their homework from last week here are the links again:

a) https://explorerhop.com/blogs/gallery/which-bank-for-me

b) https://explorerhop.com/pages/mission-which-bank-is-for-me

2) This week's homework

a) Use their debit card to Withdraw and Deposit money. They need to withdraw from the teller and then deposit using the ATM. They know what to do so parents are advised to just sit and let them go ahead and talk and figure it out. It's important they do it themselves as it helps them understand how the bank works.

b) If they have not opened their bank accounts at Meridian (Yonge & St Clair) - go ahead and do it as the offer for $50 expires on Saturday. If you are going there on Saturday, email Kerelle (Branch Manager) and set up an appointment. Her email is: Kerelle.Lovelace@meridiancu.ca . For branch hours and location scroll below.

c) Complete this Homework which helps them decide how to allocate funds in their account. https://explorerhop.com/pages/mission-create-a-financial-portfolio

d) Level 1: Come with 2 stocks that you are interested in investing.

Level 2: Come with 5 stocks you are interested in investing.

Discussions at home: Children and parents are encouraged to talk to parents about Risk Tolerance in terms of Money and what the philosophy is of the family and why they came upon this thinking. There is no right / wrong answer in this, it's simply to make kids aware of the choices parents make and what drives these choices.

NOTE: No class on October 7 (Thanksgiving Weekend)

See you next week!

_________________________

Week 1 (September 16, 2018)

Our senior group had many interesting conversations in class.

We started the lesson by understanding how much disposable income an adult has. They were shocked to learn that their parents pay 50% in taxes and even more surprised to see how little money is left once Canada Revenue takes it's share. This was followed by them calculating how much it costs for a parent to raise a child including the cost of private school (approx $596,000 until the child is 18). This was certainly eye opening for them. They now understood the need to save and to learn how to invest.

We then started s discussion on how to save. They learnt about the Money Tree, seed capital and to ask themselves 3 questions before they buy something:

- Do I need it?

- Will I use it?

- Will I enjoy it?

They also learnt how to start saving early and stop wasting. We then learnt about the banking system and how there are mainly 4 different types of banks in Canada and what is good/ bad in all of them. This was followed with an understanding of the different accounts available to them (Savings, Checking and Youth).

All kids are getting information from the bank which has NOT been simplified for kids. The purpose is for them to get familiar with regular bank material and learn what kind of information they should look out for.

Homework (due Friday, September 21)

1) All kids need have a bank account. To facilitate this, we have organized for them to get $25 free when they open a Youth Account with Meridian Credit Union and in the next class they will learn how to operate the account. They will also get a Debit Card and we will also teach them how to use that safely. This is important because we will be using this account to teach them how to withdraw and deposit safely.

If your child has siblings, you can also get $25 off an account for them.

To open the account, please go to the following bank:

MERIDIAN CREDIT UNION

26 St Clair Ave E ( Yonge & St Clair)

Hours: Monday to Wednesday: 9.30-5.00pm

Thursday and Friday: 9.30 - 6.00pm

Saturday: 9.30am - 3pm

Speak to: Kerelle (Branch Manager) or Jade. Please tell them your children are enrolled in Explorer Hop program. Kids are encouraged to take the initiative and speak directly to the Bank Manager. The Branch has an amazing kids outreach mandate and I would recommend you take the time and go there.

You can only get $25 free if you go to this branch.

You will need to take the following documentation with you to open the account:

- Govt issued ID for you and your child (drivers liscence, passport, birth certificate)

- SIN Card / SIN Number

- Proof of Address if not on driver licence

2) Teens need to complete this online form to identify their saving goals.

3) Teens need to do an analysis of the different types of banks and complete the form here.

4) Review the sheet on different account types and ask questions next week on anything they don't understand. I would like them to be completely at ease with the material in that sheet as these are the basics of most accounts they will open in the future.

Discussions at home:

Spend some time discussing with the family to see how they can help the family save money every month from their budget. The goal really is to get parents and kids talking about money matters that impact them.

See you next week!

Getting Ready for Our Class

Dear Parents

Thank you for entrusting us with teaching your child about money. We are excited to meet the kids and work with them over the next few weeks.

Here is some information to make your first day easier.

- Classes are held at Spring Garden Baptist Church, 112 Spring Garden Ave, North York, ON M2N 3G3 (Corner of Spring Garden & Kenneth)

- Our classes are held in the Boardroom on the upper level.

- Parking is available behind the church if you enter on Kenneth Street.

- Classes start at 3.45 pm and doors open at 3.40pm. All kids should be picked up at 4.45pm.

- NO PHONES OR DEVICES allowed in class. We find this distracts from the learning.

- Children should bring a non-messy snack and a water bottle.

- Kids will get a little homework to do every week (find stocks, compare interest rates etc). This should be done and submitted online by Thursday. All responses will be shown on our web site.

- Should you have any questions, please feel free to email me at hello@Explorerhop.com or phone/text me at 416-833-1782. If this is during class, I will return your call after class has ended.

- Waivers needed! We will need some waivers signed on Sunday to allow us to post images of your child on our blog, kids walk home alone etc. Please sign those when you drop off your child. Click here for the document.

- Please bookmark this page as you will get updates every week on what we studied, portfolio winners and what homework they need to do.

See you on Sunday!